Identify and Manage Pay Inequities

Start with a Design and Data

Compensation Designs are made up of 4 critical elements:

1. Compensation philosophy, which provides a high-level view on the aims of the organization with regard to compensation

2. Compensation strategy, which focuses in on how your organization intends to accomplish the philosophy. In particular, it outlines the talent markets and level of competitiveness to those markets, and it answers the question: what do you want to reward?

3. Compensation structure, which provides a mathematically sound way of aligning your positions to market and internally as well. A compensation structure is typically made up of grades and ranges, and organized into multiple schedules in larger organizations

4. Compensation policy, which ensures that the compensation plan is carried out

In order to determine if you’re paying fairly to market, you’ll need to choose your compensation strategy, including your competitive talent market and your target market percentile. Competitive pay strategies have a high impact on attraction and retention of top talent. The other consideration in choosing your strategy has to do with what you can afford to pay for top talent. The strategy you choose will depend on what you are trying to accomplish as an organization. Some may target the 40th percentile because they can’t afford more, yet if they are a highly value driven organization with a big social impact, employees may be encouraged to stay for reasons other than compensation. On the other hand, some go-getter organizations may target the 90th percentile!

With your compensation strategy and overall budgetary considerations in check, you’ll apply your compensation strategy to solid market data. In order to do so you’ll need to account for three things:

1. Price to the job not the employee. By pricing your jobs, you are pricing according to your strategy, which then in turn enables you to compensate, recruit, and attract employees at the right level for your organization. Managers tend to want the most skills possible for any position, but it may be that your company only needs a moderate skill-level for the vast majority of your positions.

Pricing by the job requirements will identify the midpoints of your ranges, employee skill-sets and experience determine position within the range.

2. Know your jobs. Another thing to keep in mind in getting reliable market data is to appropriately benchmark your jobs. This means a need to know your positions. Go beyond just title matches to matching the key responsibilities and tasks for your benchmark jobs. What are the top three functions? What kind of decision-making authority? What typical tenures do you seek for your roles? Are there required degrees or certifications and if so, how do you plan to reward education?

3. Use reliable sources of data. There are three main ways of obtaining market data: a) traditional surveys, b) online data and software, and c) custom surveys. Be sure to check the credibility of your source, consider the methodology used, see that it covers your appropriate competitive set, ensure that it fits your budget, and finally, use real-time and accurate data

Once you have a clear sense of your compensation design, you’ll need to begin your budget planning by identifying compensation inequities.

Identify Compensation Inequities

There are a few different ways in which compensation inequities can exist in an organization, from the organizational to the individual level.

Organizational or Design Level Inequities

At the organizational level, there are essentially two key questions:

• Are we paying fairly to market?

• Are our ranges competitive with the market?

Your analysis should then begin by comparing your pay for your full organization to the market (at the targeted percentiles). The typical measure used is a market ratio, which compares employee pay to the market values for the position to which they’re assigned, at the targeted percentile. A market ratio of 1 says that you’re paying at market values. A market ratio greater than 1.2 says that you’re paying high to market, and below .8 says that you’re paying low to market.

Next check how your current structure is holding up relative to the market. How do your range midpoints align to the market values for your positions? The market value represents the proficiency point for a role. A range midpoint typically also reflects that proficiency point, where incumbents would come in at or towards the minimum of the range. Then as they gain in skill sets, performance, experience, tenure – whatever matters to your organization – they would progress through that proficiency point towards the max of the range. If your range midpoints are, on the whole, more than 3 different from the average market values for your jobs, you may be out of alignment with the market. It bears further review at the job level, however, as it could also be true that you have some jobs that have shifted significantly, but that most have stayed relatively consistent year over year.

In order to stay competitive to your market, you’ll want to examine your ranges on an annual basis to check that they remain relative to market values on the whole. Create a report that shows the difference between your range midpoints and the market. Look through your positions. Have most gone up? Most gone down? Is there a mix? If most positions have moved up, you will want to consider moving your ranges by 1-3 percentage points. One thing to keep in mind: just because you’re moving ranges doesn’t necessarily require you to adjust pay.

Often folks wonder how often they should be examining and adjusting their ranges. For the most part, this will depend on your organizational size, industry, and compensation strategy. That said, you’ll want to check your ranges at least on an annual basis. Typically ranges move every 2-3 years, however your organization may exist in a context that requires more rapid change.

Department Level Inequities

At the department level, there is one primary question: Are we paying fairly across departments? Ultimately, paying fairly across all departments does not necessarily mean paying equally across all departments. It may be true that you’re targeting some departments at the 75th percentile, while others are at the 55th or 50th percentile. As long as the strategy aligns with business goals, you’re in good shape. Make sure that you are in fact aligning your compensation design, pay strategies, targets, and talent markets with your business goals, and communicate that clearly.

Position Level Inequities

At the position level, there is one primary question for investigation: Have some of our positions moved faster in the market than others?

What we know about today’s market is that it is first and foremost volatile and inconsistent. From year to year some positions may move as much as 10% or more, while others may stay still and yet others may decline. Consider, for example, the medical records associate. The value for that position has consistently declined as EMRs have become the primary way of storing medical information. As such, pay for EMR specialists is on the incline while pay for paper medical records associates continues to decline. The primary way to identify position-level inequities is a comparison between the range midpoints and the market values for each position. Additionally, there are some compensation management systems in market that can provide a market trends analysis, showing you how much each of your positions has moved each quarter over the past year.

Your critical positions may move faster than others in the market. Be sure to review these positions on a quarterly basis. Listen to your employees and be aware of any flight risks. You could consider adjusting the grade level and perhaps employee pay in those roles. Or, you may offer a market premium bonus for the roles until your annual comp review time. Be prepared to adjust pay between cycles for your critical roles. And, as always, when you make adjustments to grade assignments, watch the ripple effect that it will make as you strive to maintain that optimal balance of both external and internal equity within your organization.

Individual Level Inequities

At the individual level, investigate: Are we paying employees fairly based on our compensation strategy and their Equal Employment Opportunity status?

There are essentially two types of individual level inequities that we need to regularly test for. Have we somehow lost track of our pay strategy? In this case, you may have managers being paid less than those they supervise. (This is not always inappropriate in more technical positions.) Newer incumbents may be getting paid at or near the same wages as longer tenured employees. In compensation terms, these are called compression issues. Proficient incumbents in new roles may not have been brought fully within range of their new roles.

Examine both your compa-ratios and your outliers. Compa-ratios, the ratio between employee pay and the range midpoint, provide a way of checking that you’re paying appropriately to your range midpoints. Ideally, you’d keep these between .8 and 1.2. Your outliers are those that fall below range (green-circled) or above range (red-circled). If you find that you have a number of outliers, determine your plan to bring people within range – or, have a clear policy about why it may be ok not to have people in range.

The other thing to examine on a regular basis is whether there are any compliance (and potential discrimination) issues. Are you paying fairly across gender, race, and ethnicity? Checking the disparity in pay between the lowest and highest paid incumbents is one way to begin to identify inequities. Also, checking the disparity between the average pay for incumbents in each of the protected classes will ensure you are compliant with Labor Law regulations.

Develop Solutions for Your Pay Inequities

At each level of the organization, and for each inequity you identify, you’ll want to identify a way of resolving the inequity. A primary consideration, of course, is cost. How much will it cost to resolve the inequities you have identified? Are you able to absorb the inequities into this year’s increase budget, or are we talking about a larger amount that may resolve multiple years to resolve? How critical is it

that the inequities be resolved immediately? The biggest concern is the legal one. If you have identified any compliance-related inequities, the only solution is to resolve them immediately. Beyond that, there are concerns around attracting/retaining top talent and employee engagement and morale. Be sure to develop multiple strategies for how you intend to resolve the inequities. And, at all times, be thinking about how you will ultimately communicate changes to executives, managers, and employees.

Design Level Options

At the design level, you have a number of options for how to resolve pay inequities. Again, the question is, if we are paying low to market, what might we want to do about it.

• The first option is to do nothing. If your strategy is high and compa-ratios and morale are good, you may get by for another year without needing to adjust your ranges to market

• Another option would be to make small incremental change. The market may suggest moving your ranges by 3 percent or more. You could decide, instead, to move your ranges by 1 percent each year for the next few years

• You could decide to update your compensation strategy. Perhaps one function within your organization is more critical than others. You could move the ranges for that function but not the remainder of your organization

• Or, you could decide to adjust all your ranges at once

The solution you choose needs to be appropriate to the context of what’s currently going on in your organization, and what’s coming down the line. In some organizations, the sense of one for all and all for one is very strong, so it would be challenging to treat one function differently from the rest. In others, the need to communicate paying fairly to market is more urgent.

One thing that will help you in your decision-making is to think about the cost of the various solutions:

• How do you plan to do your increases for the next year? Just moving ranges doesn’t automatically necessitate doing individual increases. If anything, it helps make the ceiling a bit higher and gives a sense of potential to employees

• Or are you intending to maintain compa-ratios by doing an across the board market-based increase? If you plan to do this, how will you handle under performers?

• Or, are you planning to do increases by position in range? If so, what’s the dollar impact of employees falling out of range in the green? How many former red-outliers may now be eligible for increases?

Position Level Options

You also have options for how to handle inequities at the position level:

• Keep the position where it is. You may have high compa-ratios, but that may be ok for this year

• Move the position to a new grade. Is this a hot job that may come down again in a few years? Or is this a new job that’s gaining momentum in the market? As you decide to bump jobs up a grade, keep in mind that it’s sometimes challenging to bump them back down again. Think about how you will communicate grade movement to the managers and employees involved in the position

• You could also keep the position where it is, but offer a temporary market premium. Let the people in the position know that you acknowledge that the position is hot right now, and in order to remain competitive, you intend to offer a premium on top of base pay

In terms of budgeting position level inequities, you’ll need to calculate the cost of moving your position to a new grade. Have you created any new green or red outliers? What’s the dollar impact? Or, what’s the cost of the market premium you’ll be offering folks in temporarily hot jobs? There’s an advantage to offering a temporary premium in the mid-term, in that your increases next year will be based off the same base salary as this year. This isn’t a long-term solution; however, as eventually the incumbents in that role will wonder why the organization doesn’t just adjust the grade up.

Individual Level Options

At the employee level, the first consideration is to identify if there are any critical issues. Critical issues are those that would potentially lead to any litigation around perceived discrimination. They would come up if you have identified pay inequities based on Equal Employment Opportunity category. These are essentially not optional issues, and need to be resolved as soon as possible after discovery.

Other employee level issues aren’t as critical. Some of the considerations are:

• How do you want to handle compression issues? Pay compression exists when you either have new incumbents in a role that are paid at or near the same rates as more highly tenured employees or when your supervisors are being paid at or below the rates of those they supervise

• How will you handle disparate pay issues that aren’t related to EEO issues? Does your organization have or need multiple levels of the job? Are some incumbents paid either high or low to ranges based on tenure at the organization? Is there some reason for the disparate pay to be as is? Or is there an issue you intend to resolve by increasing some pay and freezing others?

• Are there any concerns amongst your green outliers that won’t be remedied with a regular pay increase? If you have high-performing incumbents paid in the green, you definitely want to calculate bringing them at least to the bottom of the range. Sometimes, the number of employees being paid in the green is too much to resolve in one increase cycle. If this is the case, develop a multi-year plan to remedy the pay inequities

For individual level inequities, start with the critical adjustments. From there, calculate the amount that would be needed to remedy any compression issues. Do you plan to give increases to supervisors and/ or existing employees? And finally, calculate the amount and the process for targeting green-circled employees so that you can bring them closer to or within range.

Once you have calculated what it will cost to remedy pay inequities at the organizational, job, and individual levels, you can then turn your attention to calculating increase amounts for your employee population.

Calculate Raises and Develop Budget Requests

When it comes time to calculate your increase amounts, there are a couple steps you’ll want to take well in advance. First, think about what you want to reward with your increase dollars. Also, take some time to streamline your increase process so that it can run swiftly and efficiently, amidst the other initiatives you’re working on. Once you’ve accomplished those two steps, you’re ready to calculate raises and summarize them in a budget request.

Know What You Want to Reward

Deciding what you want to reward is the very first step in calculating your increases and you have options:

• Market Trends. If you decide to base your increases primarily on the value of your positions in the markets, you will be allocating your increases by position in range. So, those who are lower in range get a higher increase than those employees falling higher in range. Over the long term, employees know that they are paid fairly to market, but aren’t given a major incentive to perform better

• Performance. If you decide to base your increases on performance, increases are allocated based on both performance and position in range. This means that those with higher performance get a higher increase than those with average performance. Ideally, those with low performance would not get an increase so that you’re really driving home your compensation philosophy of paying for performance. Over the long term, employees will know that they are paid fairly based on their outputs, efforts, and contributions

• Proficiency. If you decide to base your increases on proficiency, you are allocating your increases based on how well your employees know various aspects of the job. Over the long term, employees learn quickly and rapidly learn the basics of the roles, but often there isn’t much incentive to go above and beyond

• Tenure. Finally, if you base your increases on tenure you are giving a flat increase that will reflect how long your employees have been in their roles and/or with the organization. In the long term, employees will know that they just have to stick around long enough to keep getting increases. There is a very low incentive to perform well with tenure-based increases.

What About COLA?

A quick note about cost of living adjustments: they typically are not recommended, as they encourage mediocrity and aren’t a strategic way of spending limited budget dollars. One of our clients talks about what they call a mirror breath test. They have jested that at increase time they could hold a mirror up in front of people and if it fogs they’d give an increase. The idea is that just breathing should not be grounds for an increase. It’s essentially not a wise investment of compensation.

The other way that cost of living is often brought up is to differentiate pay in various geographic areas. Again there’s a danger in stopping at an evaluation of cost of living alone. It doesn’t take into account demand for labor in various areas. An example is looking at the differences in the cost of living in Minneapolis and New York. Costs of living are much higher in New York. That said, when examining

the cost of labor for a cook in either area, we’d find that the demand for cooks is much higher in Minneapolis because the supply of cooks is so low. Therefore the cost of labor for cooks is actually higher in Minneapolis, and a restaurant operating there may actually end up paying more for a cook than a similar restaurant in New York.

Ultimately it’s up to you and your organization to determine how you want to reward your employee population. You may not decide to reward your full population in the same way. In order to move on to the next steps to calculating your increases, you will need to make some determination about how you intend to reward your employees. Generally, in a market where budgets are limited, it’s most effective to pay for performance.

Streamline Your Increase Process

Now that you’ve determined how to reward your employees, the next thing to consider is how to streamline your increase process. It will depend on your organizational values around transparency and inclusion. Also, knowing the basis for your increases, performance, proficiency, market, etc, will impact the timeline for your process. And finally you need to create that timeline.

In thinking about your organizational values for transparency and inclusion some questions to ask are:

• Who needs to decide on the increases?

• Who needs to be included in the increase process? Some organizations will include their managers in the increase process, while others will not give any discretion to their managers. So whether or not you include your managers will have an impact on the timeline for your increase process

• Who needs to be informed about the increase process?

• How quickly are you able to turn around information at each of the stages of your process?

• What’s the commitment from the top?

• One last thing to consider, in terms of developing a timeline, is whether or not you have peak periods when your managers or your executives will be busy. Or are there times when there is high travel? Having your key decision-makers otherwise occupied can tend to slow down your process for approving increases

Based on market, performance, or a combination of the two, you’ll next need time to do a market study and to plan your performance cycle to end before your pay cycle starts.

One other thing to think about is whether you intend to do focal or anniversary date increases. Focal increases are when you implement all of the increases for your full population at the same time. Anniversary date increases base the timing of your increases on either the hire or promotion date of your employees. The advantages to anniversary date increases are primarily that you’re spreading out the impact or cost of increases throughout your full fiscal year. The advantage to doing focal increases are that it’s easy to budget actual increase amounts for your full population at once. It’s also easier to align your increases to the accomplishment of your organizational goals and your business objectives.

So your process for your increases could look something like the following:

• July through October, complete a market study so you know the value of your positions. At the same time conduct your performance evaluation process

• Towards the end of October, create spreadsheets with projected increases for your employees

• At the beginning of November, train your managers on the compensation process and their role in it. Following that you would deliver the spreadsheet to the managers for their input and recommendations regarding increases for the employees they supervise. Alternatively, you could tie in the compensation training with your performance training in July

• At the end of November, have some time for edits by your managers and HR

• At the beginning of December, finalize your increases and obtain final approval for your compensation plan

• At the end of December, communicate the increases to employees and make payroll adjustments

• First January payroll, the new pay goes live

Your process could be speed up if you have less manager participation or if you give tighter timelines.

Definitely keep things like travel and peak work periods in mind as you develop your timeline. Also, there are ways to further streamline by calculating the pay inequities at the organizational job and individual level why your managers are reviewing the increase recommendations.

Calculate Raises

The next thing to work on is how to actually calculate your increases. There are a few different methods that we can use depending on what you decide to base your increases. We’ll look specifically at two methods, market-based increases and performance- or proficiency-based increases.

Market Based Increases

In market-based increases, you have decided to tier increases by position in range. Start with the budgeted increase percentage overall for your organization, and allocate increases to employees based on how far they have progressed through their range. This would be done based on range penetration for your employees.

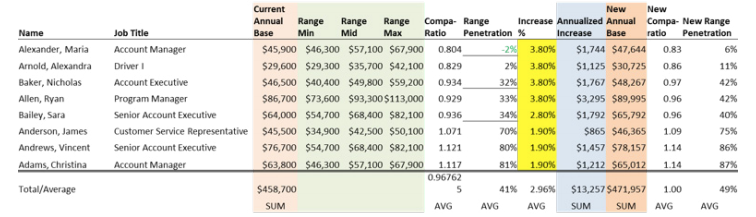

It can be done manually in Excel, there are better, more modern choices available to you such as Compensation Management Applications that can help you calculate increases automatically. Next you would create an increase recommendation spreadsheet. On that spreadsheet you should include all the information managers would need to review in order to make effective decisions about pay.

The following formulas are used to calculate some of the key fields:

• Compa-Ratio = Current Annual Base / Range Mid

• Range Penetration = (Current Annual Base – Range Min) / (Range Max – Range Min)

• Annualized Increase = Increase % * Current Annual Base

• New Annual Base = Annualized Increase + Current Annual Base

• New Compa-Ratio = New Annual Base / Range Mid

• New Range Penetration = (New Annual Base – Range Min) / (Range Max – Range Min)

Once you have the full organization-wide spreadsheet set up, divide it out by division or manager, whatever is the right level of input. Meet with your managers directly to walk through the spreadsheet. Explain to them what’s on the sheet and any parameters or guidelines if they are in fact able to make edits to the recommended increases. Some examples of guidelines might be to tell your managers that they have discretion to edit increases up to a certain percentage, a certain overall budget increase dollar amount may not be exceeded, or a certain overall percentage increase my may be allowed. Their process is to adjust the highlighted column either up or down, thus giving their input on increases for the employees that they supervise. Any discretion exhibited by managers should be clearly documented, so that the rationale for the change is clearly understood.

Performance or Proficiency-based Increases

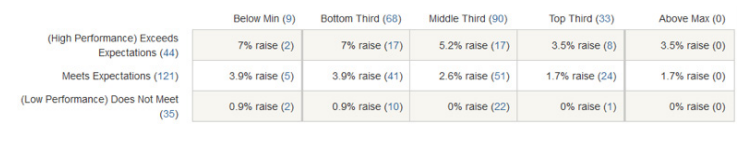

If you decide instead that you would like to base your increases on either proficiency or performance, you can use a matrix to calculate your increases. You would be then tiering your increases by position in range and performance or proficiency whichever you are aiming to reward. Here again you would start with the overall organizational budgeted increase percentage. Then allocate increases to employees based on both range penetration and performance.

As you can see below in the matrix higher increases would be given to those who exceed expectations and are below minimum or in the bottom third of the range. Lower increases are calculated for those who are either meeting expectations or not meeting expectations and those who were higher in their ranges.

Again an easier way to do this is with an automated Compensation Management System. It can also be done manually in Excel if needed. From here you would follow a similar path as the market-based increases: Create a spreadsheet, separate it out by division or manager, train your managers and give clear guidelines, and allow for a round of adjustments if are allowing them any discretion.

Prepare Summary Budget Request

At this point we have calculated our pay inequities at the organizational, job, and individual levels. We’ve also calculated our increases and determined the actual amount that we intend to give our employees. What we need to do now is put it together on a budget increase request sheet.

Range Adjustments

At the organizational level, the question that you have answered is whether or not you need to make any range adjustments. These would be necessary if your ranges fall out of alignment with your market and you have determined that it is time to adjust your ranges up.

There are two ways to handle range adjustments. You can decide to maintain your compa-ratios by adjusting every employee to the same compa-ratio in the new ranges. In this case, the cost will be equal to the percentage that you are increasing your ranges. For example, if your total payroll budget is $15 million and you increase your ranges by 2 percent, the total impact is $300,000.

If you instead decide to ensure there are no green outliers, the cost of adjusting your ranges would be equal to the adjustment necessary to keep all employees within range at the low end. So for example, if the adjustment to your ranges result in underpayment of your employees by $9,200 that would be the increase amount you would need to budget.

Market Adjustments

At the position level, the way that we are looking to correct inequities would be to make market adjustments. These would need to happen if you examined your positions relative to the market and determined that some are in fact outliers relative to the market. Outliers happen either when you have positions that fall low to market or when you have positions that fall high to market. There are two options for making market adjustments.

The first option would be to move the position to a new grade. In that case, the budget question to ask is what would be the cost of ensuring all incumbents are within range for the new grade. If you decide to move your positions to a new grade, watch your internal equity. For example, if you have a Driver I and a Driver II in grades 1 and 2 respectively, it wouldn’t make sense to move your Driver I up to grade 2 without also adjusting your Driver II to a grade 3.

In the above example, the cost of the market adjustment to enter on your budget increase spreadsheet for both the Driver I and the CSR position would be 500 total.

The other option for doing market adjustments at the position level would be to offer a market premium. A market premium is a bonus payment paid out to those employees in a job that may be temporarily high relative to the market. For example, software developer jobs are currently hot in the Seattle market. For jobs that may fluctuate both up and down in the market, it may make more sense to offer a temporary market-based premium to incumbents in the role. This way you can both encourage retention of those employees, without risking overpayment in the future. To calculate the budget amount, determine the yearly market premium payment to all incumbents in the role. The advantage to doing a market premium rather than adjusting the grade is that it’s easier to take a premium away than to reduce base pay down the line. It’s also easier to stop giving a market premium than to move a position down a grade in your structure later on down the line. One other option, if you find that you have a whole function that has jobs that are trending up and down rapidly, is to build a temporary alternate structure for that hot function in your organization. Then you can more easily adjust the ranges, and communicate that clearly to your employees once the demand for that job function cools off.

Equity Adjustments

The types of adjustments at employee levels when you identify employee level inequities are equity adjustments. After doing your homework on employee level inequities, you may have identified some issues around compression or equal employment opportunity issues. Equal Employment Opportunity issues are not considered optional to correct and need to be addressed as soon as possible. You would do this by determining the amount to resolve the critical issues. Let’s take a closer look at the example below.

Another employee-level inequity is a compression issues. After identifying them, you can then resolve those issues by determining if you need to give increases to existing employees.

In this example we have a male and female in the same role. The female is below range and the male is well into range. This could potentially be perceived as discrimination, and leaves the door open for a lawsuit. To resolve the issue, you would need to bump up the pay for Vanessa Gonzales to at least to the bottom of the range. The budget would reflect an equity adjustment of $3,700.

In the example shown above, we have two employees in the HR area. The manager is being paid less than the HR generalist, so we would most likely want to increase the HR manager at least to the bottom of the range. In this case, the fix in the first example resolves also the problem in the second example, so we would want to ensure that we are not double counting that increase in our budget calculation.

Finally, in terms of employee-level inequities, are any other necessary market adjustment for individuals to include on your budget calculations?

Pay Increase Adjustments

After budgeting the pay inequities that you may have identified in your organization, we then turn our attention to budgeting the pay increase amounts. Typically this is the easiest to budget as it is usually a percentage of the total salary budget. For example if your budget is $15 million, the total increase adjustment would be $450,000. You would enter $450,000 as the line item for pay increase adjustments on your compensation budget request.

Summary Report

Below we can see an example of a summary compensation budget request. Each of the types of adjustment that we have calculated so far has its own line item. The example might represent an organization of about 250 employees with an average pay of about $60,000.

The organizational-level inequities show up as range adjustments. Job-level inequities appear as market adjustments. And employee-level inequities are entered as equity adjustments. The pay increase adjustments of course show up on the fourth line. The total budget increase percentage, including the inequity adjustments comes to 3.23 percent. This is a fairly conservative estimate showing some very conservative choices made. The nice thing about this example is that the organization could use a budget of 4% and have some room left for discretionary payouts throughout the year. This could include spot bonuses or other things you might want to reward with your compensation dollars. Or, you could use this .76 percent as wiggle room for opportunities that might arise unplanned.

As backup for this summary page you would also want to gather and include your detailed analysis of all of the increase calculations that helped you develop the summary budget recommendations.

Once you have developed your summary compensation budget request, with supporting documentation, you’re ready to begin communicating with your executives about the request. Be sure to clearly communicate the importance of each line item, and the value to both accomplishing the organizational goals and your business objectives.